Paid search advertising is becoming more and more diverse, with a new paid platform launching seemingly every day. As more and more opportunities emerge, it’s important to understand the cost it takes to have a presence on each platform. Contrary to what you may think, different platforms have different average cost per clicks. The purpose of this post is to look at some of the top paid advertising platforms and compare the difference in cost-per-click. To better understand this, we focused on a recent client case study trying to maximize their presence in the golfing industry.

It’s important to note that this client wanted to maximize their presence. Because of this, the focus was on getting them up into position #1 as much as possible across all search networks. This was in contrast to position 2 or 3 which would require a lower CPC bid.

| Bing | Yahoo | ||||

|---|---|---|---|---|---|

| Search | $1.06 | $1.33 | – | $0.57 | |

| Brand | $0.30 | $1.03 | – | $0.40 | |

| Non-Brand | $1.74 | $2.09 | – | $1.17 | |

| Display | $0.60 | – | $1.07 | $0.50 | |

| RMT | $1.63 | – | $1.26 | – | |

| Shopping | $0.40 | $3.17 | $1.07 | – | |

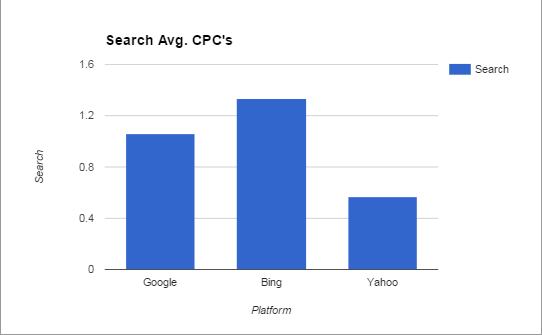

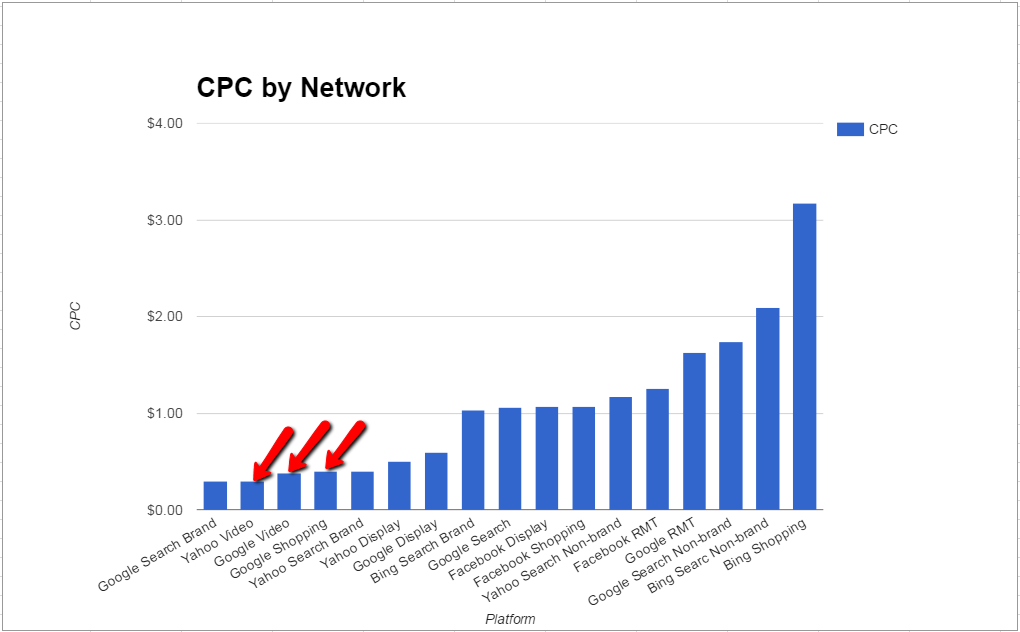

Overall, we focused on the platforms of Google Adwords, BingAds, Facebook, and Yahoo Gemini. When looking across the search networks on Google, Bing and Yahoo platforms, we saw Google’s avg. CPC sitting about 20% lower than Bing’s avg. CPC. However, we saw the lowest avg. CPC on Yahoo search at an average of $0.57, 46% lower than what we saw on Google. So for a new-to-market company looking to get search exposure at the cheapest possible cost, Yahoo Search may be a viable option. However, there also has to be considerations in terms of search volume, where Google is much more expansive. Brand avg. CPC’s were lower than Non-Brand avg. CPCs across all search networks with Google’s brand CPCs being considerably lower than Non-Brand, even lower than Yahoo Brand avg. CPCs.

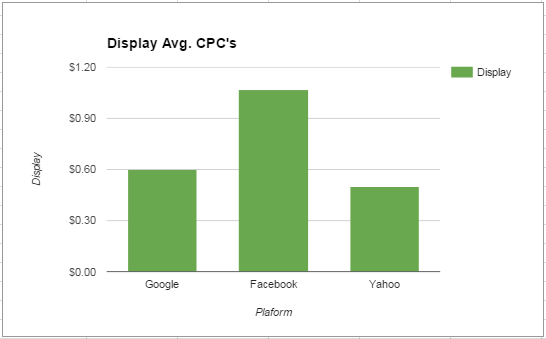

On Display we saw significantly lower CPCs for Google and Yahoo compared to Facebook, with the avg. CPCs on Google/Yahoo ranging from $0.50 to $0.60 compared to over $1.00 per click on Facebook. On a $1,000 monthly budget, taking the average CPC of Google/Yahoo compared to Facebook could help generate an additional 818 clicks with the lower CPC. That’s over 800 more chances to get a sale/lead! This is certainly something to consider when starting out in paid advertising with a limited budget.

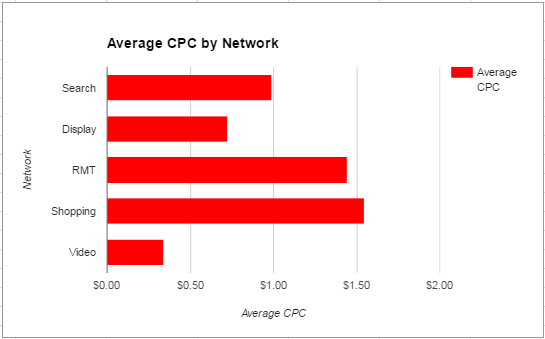

Other opportunities to help push volume with a low avg. CPC are Google Shopping and paid video advertising. Google Shopping is an ecommerce network that continues to grow in scale and competition, and these lower avg. CPCs for shopping aren’t likely to stay forever. However, taking advantage of Google Shopping in the current moment can help you gain more real estate in the search listings for a fraction of the avg. CPC for overall Google searches.

Paid video advertising on YouTube and on Yahoo remains a more challenging platform to monetize (many use it for more brand awareness campaigns), but continue to offer clicks at costs that are less than half that of avg. CPC on both Google and Yahoo search. So if you can get video advertising to successfully accomplish your ROI or branding goals, you can dominate an advertising network that remains low cost with lesser competition than other networks.

Again this is based on one industry case study, so there is likely to be some fluctuation in avg. CPCs depending on the industry and your goals. However, in comparing the different platform and opportunities on each network, there are some historically lower avg. CPC options (Yahoo Search, Google Display and Yahoo Display) and understated targeting opportunities (Google Shopping, video advertising) to help you maximize the value of your paid search campaigns.